FinTech Magazine recognizes Ant Group as the 8th best company in its Top 100 Companies in FinTech for 2024.

By embracing the innovative spirit of the fintech sector, these companies continually showcase their dedication to efficiency, innovation, and sustainability in this dynamic field. In doing so, they serve as exemplary models for those looking to make their initial moves in the fintech industry.

The 2024 report on the ‘Top 100 Companies in FinTech’ showcases the most innovative firms globally, particularly during a period when digital transformation and AI are making headlines. FinTech Magazine aims to recognize and celebrate the achievements of the top 100 companies in financial technology, as well as all fintech leaders who play a role in shaping the future of transformation, whether through financial inclusion, technological innovation, blockchain, cybersecurity, or cryptocurrency.

Glen White, CEO of BizClik.

The companies being recognized are spearheading major changes to the way we all do business. Financial technology allows business and people to streamline operations, glean better insights and take control of their financial planning. This year’s awardees are a mix of industry heavyweights and emerging growth companies. They were methodically evaluated and selected based on nomination submissions and further research into their products and solutions, customer adoption, management team caliber, organizational effectiveness, and organizational depth, among other factors.

Finastra (No. 2) powers 45 of the world’s top 50 banks with its software. Fintech (No. 4) drives B2B payments with its innovative PaymentSource.

PayJoy (No. 16) lets users turn their smartphones into digital collateral, and MX Technologies (No. 26) is the end-to-end payments platform that Dwolla chose for account verifications and aggregation in money management.

Ant Group

Ant Group has its origins in Alipay, which was founded in 2004 to foster trust between online sellers and buyers. Over time, Ant Group has evolved into one of the leading open internet platforms globally.

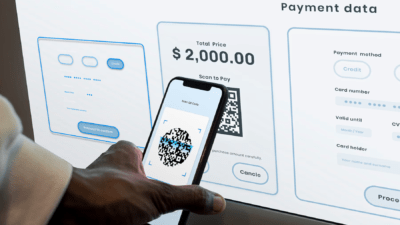

Ant Group is undoubtedly a major fintech company that has significantly shaped the digital finance landscape, particularly with its leading product, Alipay. Launched in 2004, Alipay has now become one of the largest mobile payment platforms in the world, boasting over a billion users. Consequently, it has transformed how people conduct transactions, making it simple to pay for goods and services, transfer money, and manage personal finances directly from their smartphones.

In addition to payment services, Ant Group also offers a wide range of financial products. For instance, they provide wealth management options that enable users to invest easily in various financial instruments. Moreover, their insurance products are accessible and affordable, specifically targeting a broad audience, including those who may not have had access to traditional insurance.

Furthermore, a notable aspect of Ant Group is its use of big data and artificial intelligence to evaluate credit risk. This innovative technology allows them to provide credit services to individuals and small businesses that might not qualify for loans from traditional banks. Their credit scoring system, known as Zhima Credit, effectively assesses users based on transaction history and social behavior, thus leading to a more inclusive credit assessment.

Additionally, Ant Group is at the forefront of exploring blockchain technology to improve the security and transparency of financial transactions. They have actively engaged in various initiatives related to digital currencies and have partnered with central banks on projects focused on digital currency development.

In 2020, Ant Group aimed to launch one of the largest IPOs in history; however, regulatory changes in China ultimately resulted in the suspension of their listing. Nevertheless, the company continues to move forward, emphasizing innovation and financial inclusion, with a goal to create a fairer financial ecosystem that benefits a larger population worldwide.

Ant Group has played a pivotal role in revolutionizing the fintech sector, particularly in China and beyond. One of the key insights about Ant Group is its commitment to financial inclusion. By leveraging technology, they aim to provide financial services to underserved populations, which is a significant step toward bridging the gap between traditional banking and the unbanked.

Another interesting aspect is their ecosystem approach. Ant Group doesn’t just focus on payments through Alipay; they have developed an extensive ecosystem that includes e-commerce, cloud computing, and logistics. This interconnectedness allows them to offer tailored financial solutions that cater to the diverse needs of their users.

Ant Group’s emphasis on innovation is evident in their continuous investment in research and development. They are exploring cutting-edge technologies such as artificial intelligence and blockchain to enhance their services. For example, their use of AI in risk assessment not only improves efficiency but also reduces the chances of fraud, making transactions safer for users.

Additionally, Ant Group’s international expansion strategy is noteworthy. They have been actively looking to extend their services to other markets, which includes partnerships with local fintech companies and financial institutions. This strategy not only helps them grow but also allows them to adapt their offerings to meet the specific needs of different regions.

Lastly, the regulatory landscape poses both challenges and opportunities for Ant Group. While regulatory scrutiny has increased, particularly after the halted IPO, it also encourages the company to innovate and comply with global standards, which could enhance its reputation and trustworthiness in the long run.

Overall, Ant Group’s blend of technology, innovation, and a focus on inclusion positions it as a leader in the fintech industry, with the potential to shape the future of digital finance globally.

Through its technological innovations, Ant Group assists its partners in delivering inclusive and convenient digital lifestyles and financial services to consumers and small to medium-sized enterprises (SMEs). Furthermore, it has been rolling out new technologies and products to aid the digital transformation of various industries and promote collaboration among them. By collaborating with global partners, the company allows merchants and consumers to make and receive payments and transfers worldwide.

paraphrase; If we talk about digitalisation, I think digitalization primarily enhances connectivity and accessibility. For the new AI paradigm, it brings about the biggest change: personalization or lifelong personalized services.

Eric Jing, CEO of Ant Group

Congrats to everyone on our Top 100 Companies in FinTech list! You’ve earned your spot with your amazing work in adopting new technologies and solving real-world problems.

Check out who else made the Top 100 Companies in FinTech, click here.