Learn how financial inclusion technology empowers underserved populations through mobile banking and blockchain.

Banking Systems

Financial inclusion technology is reshaping the landscape of financial services, making it accessible to millions who have been underserved for a long time.

With approximately 1.7 billion adults lacking access to traditional banking systems, the urgency for innovative solutions is high. This technology has a variety of tools and platforms that empower individuals in low-income and remote areas, enabling full access to essential financial services such as savings accounts, credit, and insurance.

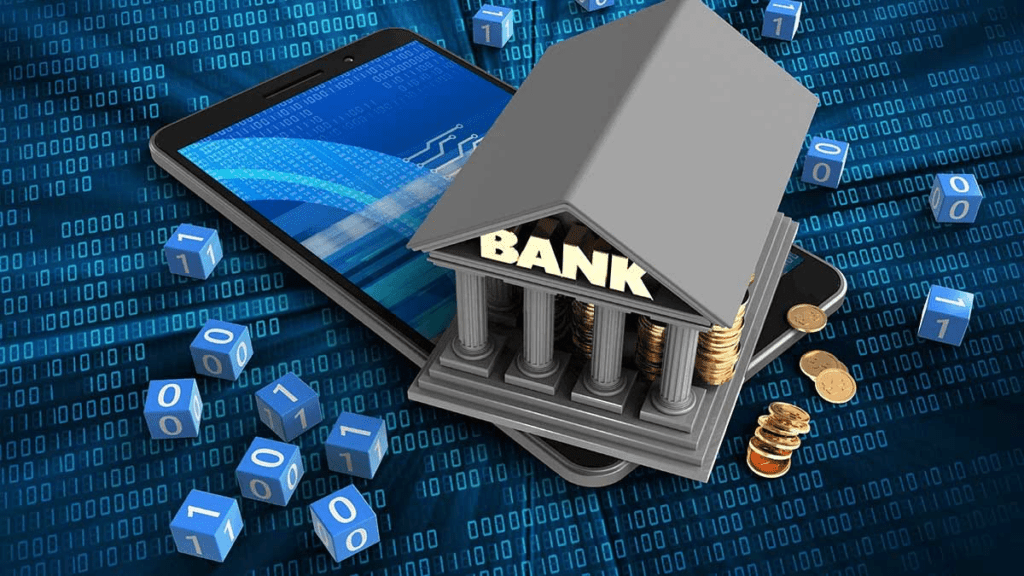

Mobile Banking as a Financial Inclusion Technology

Mobile banking applications have emerged as a game-changer in this day and time. These apps allow you to perform financial transactions directly from your smartphones, eliminating the need for physical bank branches. For example, M-Pesa in Kenya has transformed the way you can send and receive money, allowing millions of individuals to participate in the economy without traditional banking infrastructure.

This accessibility has simplifies daily transactions and encourages entrepreneurship, enabling individuals to start small businesses and improve their economic situations.

Digital Wallets as a Financial Inclusion Technology

Digital wallets is another critical aspect of financial inclusion technology. It is a secure and convenient way for you to store and manage funds.

By integrating payment solutions into your everyday activities, digital wallets helps in e-commerce, bills payment, and transfer of money with ease. This is particularly beneficial in regions where banking services are limited or non-existent.

Blockchain Technology

Another pivotal role in enhancing this technology is blockchain technology. By offering a decentralized and secure transaction method, blockchain reduces the costs associated with traditional banking. It also enables access to financial services in remote areas where banking infrastructure is lacking.

The transparency and security provided by blockchain foster trust among users, which encourages engagement with financial services previously avoided.

With the ongoing advancements and increased adoption of digital solutions, we can create a more inclusive financial ecosystem. This supports individual economic growth and also contributes to broader societal development.

In conclusion, it is very important to inculcate these approaches in our daily lives because It has the potential to empower individuals, enhance economic resilience, and pave the way for a more equitable financial future for everyone.