Essential steps to develop a successful fintech app in 2025. Explore strategies, trends, and best practices in this complete business guide.

Recent statistics show that the fintech industry is growing at a CAGR of 14%. It’s expected to reach $608.35 trillion by 2029. If you’re planning to launch a fintech startup and want to know how to develop a fintech app, you’re in the right place.

First, let’s define fintech and look at the top players in the industry. Let’s get started!

What is Fintech?

Fintech stands for financial technology, which refers to the use of technology to improve financial services. These services aim to simplify life for users. For instance, with neo banking, individuals can handle all their banking transactions from the comfort of their homes.

Today, the fintech industry is rapidly expanding beyond banking. Startups are now offering services for stock trading, loan applications, and more. Now, let’s explore the various types of fintech apps available.

What Are The Different Types Of Fintech Apps?

The fintech industry is divided into sub-fintech categories such as:

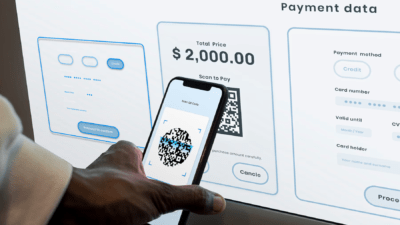

Payment and Money Transfer Apps

Fumbling with cash or writing checks feels outdated. Digital wallets and peer-to-peer payment systems changed how we handle transactions. We now split restaurant bills and pay rent with just a few taps on our phones instead of going to the ATM. These contactless payment solutions are convenient and reshape how we view money transfers.

Digital Banking and Neobanks

Traditional banking has transformed with mobile and online platforms. Digital-only banks have emerged, operating without physical branches. These banks often offer better rates and innovative features, challenging the old banking model. Now, you can open an account, deposit checks, and manage your finances entirely from your smartphone.

Investment and Trading Apps

The rise of micro-investing platforms and robo-advisors democratizes investing. What used to be for financial professionals is now accessible to everyone. These apps allow you to invest in major companies with just a few dollars through fractional shares. They not only make investing easier but also educate users about portfolio management and long-term wealth building.

Personal Finance Management Tools

Picture having a financial advisor available 24/7 to track your spending and give personalized advice. Modern budgeting and expense-tracking apps do just that. They use algorithms to analyze spending patterns and suggest improvements, turning financial planning into an engaging experience that helps users build better money habits.

Lending and Credit Apps

Digital platforms have reshaped lending by offering new ways to access credit. They use innovative credit scoring methods to provide alternatives to traditional credit access.

Factors That Influence The Cost Of Developing A Fintech App

Development Team Structure and Location

The makeup and location of your development team directly influence the cost of your fintech application. A solid fintech development team needs business analysts who understand financial regulations, UI/UX designers who create intuitive interfaces, frontend and backend developers skilled in financial technology, QA engineers focused on security testing, and experienced project managers. The location of these professionals affects the budget significantly: North American developers charge $150-200 per hour, European developers range from $50-80 per hour, and Asian developers offer rates between $15-50 per hour. The challenge is to find the right balance between cost-effectiveness and the necessary expertise.

Core Features and Technical Complexity

The features and complexity of your fintech application greatly impact development costs. Basic features like user authentication, KYC verification, and payment processing typically require 100-150 development hours. More advanced functionalities such as real-time analytics, AI-driven risk assessment, or blockchain integration can demand an extra 200-400 hours. Complexity skyrockets with features like multi-currency support, automated trading algorithms, or advanced fraud detection systems.

Security Implementation and Compliance

In fintech, security and regulatory compliance are crucial and significantly affect development costs. You must implement strong security measures, including end-to-end encryption, secure payment gateways, and multi-factor authentication, which require a substantial investment. Additionally, ensuring compliance with regulations like GDPR, PSD2, or SOX requires specialized expertise and extra development time. These security and compliance needs usually account for 20-30% of the total development budget.

Infrastructure and Third-Party Integrations

The technical infrastructure and necessary third-party integrations significantly contribute to the overall cost. You need to invest in cloud hosting services, database management systems, and server maintenance. Integrating with payment gateways and banking APIs also incurs additional costs.

Process Of Developing A Fintech App

Here is a detailed process for developing a mobile app that ensures quicker time to market with all the important features:

Discovery and Research Phase

The journey of developing a fintech app begins with comprehensive research and discovery. This crucial first step involves analyzing market needs, identifying target users, studying competitors, and understanding regulatory requirements.

Development teams need to conduct thorough market research, user interviews, and stakeholder meetings to define clear objectives. During this phase, it’s essential to identify the specific financial sector problems your app will solve and understand the regulatory landscape in your target markets. This research typically takes 1-2 weeks and forms the foundation for all subsequent development decisions.

Planning and Documentation

With research insights in hand, the next phase focuses on detailed planning and documentation. This includes creating comprehensive technical specifications, defining the product roadmap, and establishing development milestones.

Teams develop wireframes, user stories, and detailed feature specifications. The planning phase also involves creating risk assessment documents, compliance checklists, and security protocols. This documentation serves as a blueprint for development and typically requires 2-3 weeks of focused effort from business analysts, project managers, and technical architects.

Design Phase

The design phase transforms abstract concepts into tangible user interfaces and experiences. UI/UX designers create detailed mockups and prototypes, focusing on creating intuitive, secure, and engaging user experiences.

This phase involves designing user flows, creating brand-consistent visual elements, and ensuring accessibility standards are met. For fintech applications, special attention is paid to designing clear financial information displays, secure transaction flows, and trust-building elements. The design phase typically spans 4-6 weeks and includes multiple iterations based on stakeholder feedback.

Development Phase

The core development phase is where the actual building of the application takes place. This phase typically follows an agile methodology with sprints lasting 2-3 weeks each. Development begins with setting up the basic infrastructure and gradually builds up to more complex features.

The process usually starts with core functionality like user authentication and basic financial transactions, then progresses to more sophisticated features like analytics and integrations. Front-end React developers or Flutter developers work on the user interface while back-end developers build the server infrastructure and API integrations. This phase typically takes 4-6 months depending on the complexity of features.

Integration and API Implementation

A critical aspect of fintech app development is the integration phase, where the application is connected with various financial services and third-party systems. This includes implementing payment gateways, banking APIs, KYC verification systems, and other financial service providers.

Teams must ensure secure data transmission, handle real-time transactions, and maintain data synchronization across different systems. This phase often runs parallel to the main development phase and requires careful testing and documentation of all integration points.

Testing and Quality Assurance

The testing phase is particularly rigorous for fintech applications due to the critical nature of financial transactions. It includes multiple levels of testing: unit testing, integration testing, security testing, and user acceptance testing. QA teams conduct thorough security audits, performance testing under various load conditions, and compatibility testing across different devices and platforms. Special attention is paid to testing financial calculations, transaction accuracy, and security measures. This phase typically takes 6-8 weeks and may overlap with development as issues are discovered and resolved.

Compliance and Security Audits

Before launch, the application undergoes stringent compliance checks and security audits. This involves verifying adherence to financial regulations, data protection laws, and industry standards. External auditors may be brought in to validate security measures and compliance protocols. This phase includes penetration testing, vulnerability assessments, and documentation of compliance measures. The audit phase typically takes 3-4 weeks and may result in necessary adjustments to meet regulatory requirements.

Deployment and Launch

The deployment phase involves carefully orchestrated steps to move the application from development to production environments. This includes setting up production servers, configuring security protocols, and establishing monitoring systems. A soft launch or beta testing phase is often implemented to gather real-world feedback before the full launch. Teams prepare rollback plans and emergency procedures for handling potential issues. The launch phase typically takes 2-3 weeks and requires careful coordination between development, operations, and support teams.

Post-Launch Monitoring and Maintenance

After launch, the focus shifts to monitoring application performance, gathering user feedback, and implementing necessary improvements. Teams monitor system metrics, user behavior, and transaction patterns to identify areas for optimization. Regular updates are scheduled to add new features, improve security, and maintain compliance with evolving regulations. This ongoing phase includes providing technical support, monitoring system health, and planning future enhancements based on user feedback and market demands.

Conclusion

Now, in the end, we hope that through this post you were able to learn how to develop a fintech app. We have also mentioned a complete guide with the types of Fintech apps and the estimated cost of developing them.