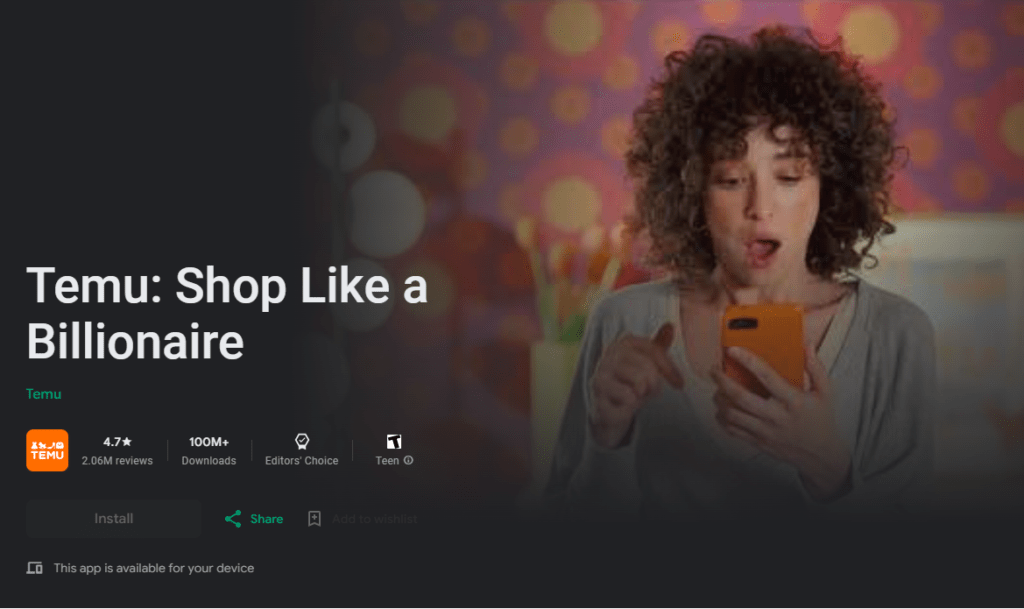

Let’s analyse Temu’s $500 million advertising strategy and its anticipated impact on the e-commerce market.

Temu’s $500M advertising budget has indeed sparked considerable discussion, especially in light of its bold marketing strategies. The allocation of approximately $500 million for advertising in 2024 is a notable investment, particularly for a newcomer in the highly competitive e-commerce arena.

This extensive budget allows Temu to effectively saturate multiple platforms, such as social media, television, and online ads, ensuring they reach a wide audience and maximize visibility among potential customers.

By leveraging this significant financial commitment, Temu aims to establish a strong market presence and compete with more established players in the industry.

The rationale behind such a substantial budget is clear

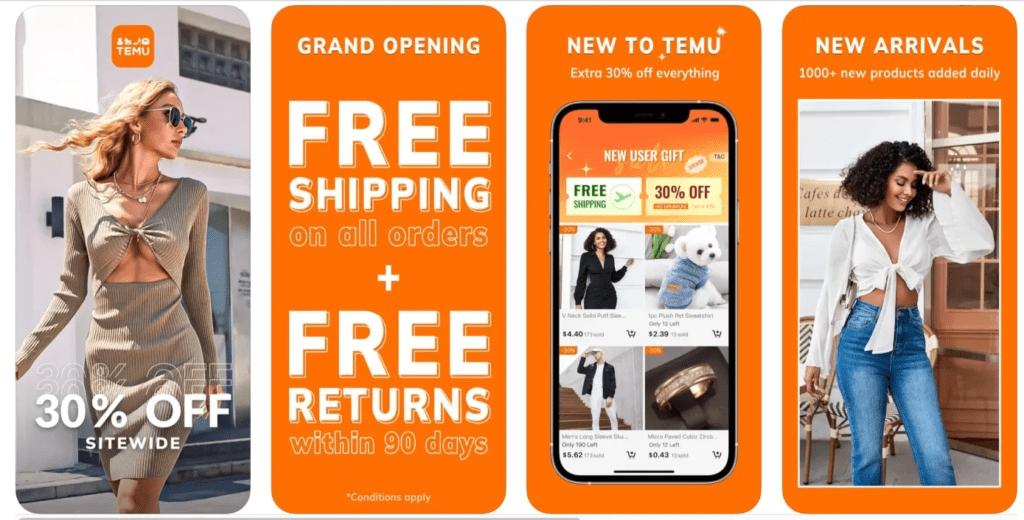

Temu is intent on quickly establishing itself in a fiercely competitive market. By making significant investments in advertising, they seek to broaden their audience reach, boost brand recognition, and draw in potential customers who may not yet be aware of what they offer.

Their strategic emphasis on digital platforms, especially social media, is particularly insightful. This approach enables them to engage effectively with a younger demographic that is increasingly inclined to shop online.

By connecting with these consumers where they spend much of their time, Temu aims to create a strong brand presence and foster customer loyalty right from the start.

This proactive strategy not only helps in building awareness but also positions Temu as a relevant player in the fast-evolving e-commerce landscape.

On Message: Temu’s $500M Ad Strategy: Market Impact

MediaRadar’s Todd Krizelman On Temu’s $500M Marketing Strategy

With $505 million dollars spent on advertising in just a year, Temu quickly went from a new e-commerce entity in the U.S. to a household name. Its commercial during the Super Bowl might have been missing celebrity cameos or memorable pop culture references, but its exposure and brand recognition appear to have paid off. MediaRadar CEO Todd Krizelman said Temu’s thrice-aired Super Bowl commercial is one of the latest iterations of a massive marketing campaign for the brand. We talked about what Temu’s strategy appears to be, and what we can expect from Temu in the future. This conversation has been edited for length, clarity and continuity

What do you see as Temu’s overall strategy?

Krizelman: The majority of the spend, something like 75% of it, is in social media. Their concentration of spend is very high with Meta on the Instagram and Facebook platforms. You could infer a couple things by that strategy. One is Facebook and Instagram are proxies for the American public in 2024. This is not some niche segment. …During the Super Bowl, I asked my daughter, ‘Do you know Temu?’ And she said, ‘Oh, I know Temu really well already.’ But I asked my mom, who’s in her 80s. She also knew Temu really well. That kind of money in such a concentrated period of time creates enormous reach to the American public.

In the Super Bowl, their ad was so different than others. Why do you think they chose this sort of an advertisement, and what kind of strategy was at play?

Most companies that spend anywhere near this kind of money do a lot of audience testing ahead of time. Despite whatever pundits say about it—I’m aware it didn’t end up in the pundits’ favorite, most fun advertisements in the endemic news—in the test that they did, my strong expectation is that this scored well.

A lot of times when a product has a very broad audience, it is sometimes difficult to use actors and actresses because people do respond to what’s in an ad. If you see only young women in an ad, subconsciously people will assume this product may be for young women.

That’s one other hypothesis: They wanted to be accepted by the whole population. And so as a result, they didn’t want to anchor it on any one demographic. That’s another clever way. It was all in their color orange. This is just fun. We’re emphasizing price and the products and the experience, and that’s it. Not allowing people subconsciously to think, ‘Maybe this is not for me.’

Why do you think they ran the same ad so many times? It’s certainly an expensive proposition.

I think it’s a way of really creating durability of the message. It is a noisy two or three hours of advertising, and if you’re already saying you’re going to spend a half billion dollars, and you’re doing it very fast, to buy three spots instead of one, [you] know that you really become part of the narrative. …They become part of the dialogue.

It is a mature market. Very saturated, lots of entrenched competitors. …You have to compete against that. I think the bar is very high to get me off of Amazon or Target or Walmart, or any of the other places who have my credit card. I have to be convinced to go there and to try it out, and that’s a big ask these days.

Bigger picture: I do think at a time when you sort of feel like, ‘Hey, isn’t e-commerce fully baked in 2024?’ No. There are new entrants willing to really buy their way in to get to the American public. That, I think, is a really fascinating thing that caught me off guard. I thought the social media narrative was also the same: There’s no one else gonna be new. In five years, TikTok absolutely became a major player in the market that none of us saw coming.

Who else has used this kind of marketing strategy in the past? How did it work?

Amazon doesn’t invest quite as much as they used to, but there was a time when every year we saw Amazon invest more and more and more. You may remember it. Even 10 years ago, there used to be all these holiday ads with Amazon, and they were just running 24/7 to condition us, to train us, to go online when that was still a newer thing for holiday shopping. …They still do it, but they don’t have to do it as much because they already have a direct conduit into your phone, for most people on their app. It doesn’t cost them anything.

Another example of this is when the big streaming stations launched. …All of that was happening right at the beginning [of the Covid-19 pandemic] when we were stuck inside our homes. We also saw major lifts to promote Hulu and to promote Paramount+ and to promote Max. These were things where they had to train people to go out and buy subscriptions. Disney+, even though we all knew Disney. In short order, they signed about 50 million subscribers in the first six months.

What do you think we’ll see from Temu in the next six months?

I certainly would not be surprised if they slowed the marketing down for a few months to see the durability of their investments. Is it working? Is there ROI? Are people buying repeat purchases? We certainly have seen that many times in the past.

There’s a lot of investment that goes into delivering e-commerce successfully. I assume, if it’s working, it’s really forcing them to expand and grow. If it was working a lot, you might actually see them slow the advertising down so they can digest all the new customers, make sure word of mouth is positive.

That people say, ‘Yeah, they delivered my product. It was great.’ If that works, and people are having a good experience, I would expect as we go into summer again, it will ratchet back up.

QUIZ

Former President Donald Trump announced his latest business venture last weekend: $399 golden sneakers featuring the U.S. flag. According to a communications firm, how long did it take for them to sell out?

A. They haven’t sold out

B. Three days

C. 12 hours

D. Under two hours

See if you got the answer right here.