Explore the latest trends in fintech, focusing on innovations in digital payments, blockchain technology, and personalised financial services

The fintech industry has been rapidly evolving, driven by technological advancements, changing consumer preferences, and regulatory developments.

As we look into the latest trends in fintech, it’s essential to understand how these innovations are reshaping the financial landscape and impacting consumers and businesses alike.

Here are some latest trends in recent time;

Digital Banking Transformation

This transformation refers to the significant changes occurring within the financial services industry as a result of technological advancements and evolving consumer expectations.

Traditional banks are increasingly adopting digital-first strategies to enhance customer experience and streamline operations, recognising the need to compete with digital-only banks, or neobanks, that are rapidly gaining market share.

These neobanks provide a range of services that cater to the needs of modern consumers, such as online account opening, mobile payments, and personalized financial management tools.

The emphasis on convenience and accessibility is a major driver of this transformation, as consumers now prefer to manage their finances through mobile apps rather than visiting physical bank branches.

This shift not only enhances your experience as a user, but also allows for more efficient operations and cost savings for banks.

As the competition between traditional banks and digital-only banks intensifies, both sectors are being pushed to innovate and improve their offerings.

Traditional banks are investing in technology to provide seamless digital experiences, while neobanks are continually refining their services to attract and retain customers.

This dynamic environment is reshaping the future of banking, leading to a more customer-centric approach and the development of new financial products and services that align with the digital lifestyle of consumers.

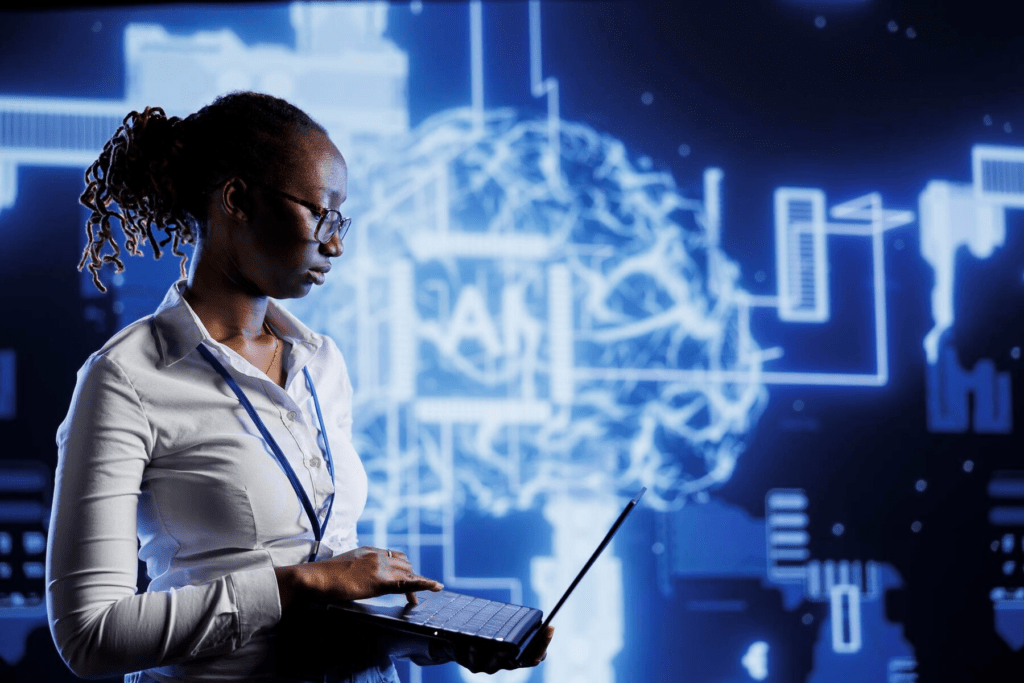

Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning (ML) are transforming the way financial institutions operate.

According to a report by Business Insider, 80% of financial services executives believe AI will revolutionise the industry by 2030, with AI-driven chatbots and predictive analytics becoming more common.

These technologies enable companies to analyze vast amounts of data quickly, providing insights that can enhance decision-making and risk management.

AI-powered chatbots are becoming common in customer service, offering instant support and personalised recommendations. Machine learning algorithms are being used to detect fraudulent activities by identifying unusual patterns in transaction data.

As these technologies continue to advance, we can expect even more sophisticated applications in areas such as credit scoring, investment management, and customer engagement.

Blockchain and Cryptocurrencies

The adoption of blockchain technology is on the rise, with the global blockchain market projected to grow from $3 billion in 2020 to over $39 billion by 2025, according to Markets and Markets.

Cryptocurrencies are also becoming more mainstream, with Bitcoin’s market capitalisation surpassing $1 trillion for the first time in early 2021.

At its core, blockchain technology provides a decentralised and secure ledger system that allows for transparent and tamper-proof record-keeping.

This innovation is the backbone of cryptocurrencies like Bitcoin and Ethereum, which have not only gained significant attention but also widespread adoption among consumers and investors.

Blockchain is being utilised in cross-border payments, offering faster and more cost-effective solutions compared to traditional banking methods.

As financial institutions begin to recognize the myriad benefits of blockchain such as cost reduction, enhanced transparency, and improved efficiency, there is a growing interest in integrating these solutions into traditional finance.

With evolving regulatory frameworks, you are likely to see greater acceptance and adoption of blockchain technologies, paving the way for innovative financial products and services that leverage this powerful technology.

This integration could redefine the landscape of finance, making it more accessible and efficient for all stakeholders involved.

Regulatory Technology

Commonly known as RegTech, is becoming increasingly important as the fintech sector expands and regulatory requirements become more complex.

his emerging trend addresses the growing need for effective compliance solutions within financial institutions.

RegTech leverages advanced technologies, such as artificial intelligence and big data analytics, to automate and streamline compliance processes, which helps organisations stay ahead of regulatory changes and requirements.

One of the key functions of RegTech is its ability to monitor transactions for suspicious activities, thereby enhancing the detection of fraud and money laundering.

By automating these processes, financial institutions can manage risk more effectively and allocate resources toward innovation rather than getting bogged down by manual compliance tasks.

This not only improves operational efficiency but also ensures that organisations maintain adherence to regulations, which is crucial in an environment of increasing regulatory scrutiny.

Embedded Finance

Embedded finance is a transformative trend that seamlessly integrates financial services into non-financial platforms, revolutionising the way businesses interact with their customers.

By allowing companies to offer financial solutions such as payment processing, lending, or insurance directly within their existing applications, businesses enhance the overall customer experience.

This integration eliminates the need for customers to navigate away from their primary interface, making transactions smoother and more efficient.

For instance, if you run an e-commerce platform, it has streamline the purchasing process by incorporating payment options that allows your customers to complete their transactions without redirecting to a separate payment gateway.

This convenience not only increases your customer satisfaction but also fosters higher engagement and loyalty. The ability to access financial services within familiar environments can significantly influence consumer behaviour, leading to increased sales and revenue for your business.

This trend is particularly impactful in industries like retail, travel, and healthcare, where the demand for convenient payment solutions is high.

In retail, for example, offering embedded finance can facilitate quicker checkouts and personalised financing options, ultimately driving higher conversion rates.

As more businesses recognise the value of embedding financial services, we can expect to see continued growth in this area, further blurring the lines between financial and non-financial sectors.

Sustainable finance is indeed becoming a significant focus as both consumers and investors are increasingly prioritising environmental, social, and governance (ESG) factors in their financial decisions.

This shift is prompting fintech companies to innovate and develop solutions that facilitate sustainable investing and responsible lending practices.

For instance, there are now platforms specifically designed to enable users to invest in green projects, which can include renewable energy initiatives, sustainable agriculture, and other environmentally friendly ventures.